As we previously reported, the ATO is undertaking targeted consultation on updating website guidance for crypto assets. Most recently, the ATO has issued new Goods and Services Tax (GST) guidance specifically relevant to crypto assets.

The ATO guidance addresses the following questions:

- How do you determine if a crypto asset is digital currency for GST purposes?

- What should you do when you receive and use digital currency as payment for goods and services?

- How does GST apply to digital currency exchanges?

- What is the GST treatment when you buy or sell digital currency?

GST basics

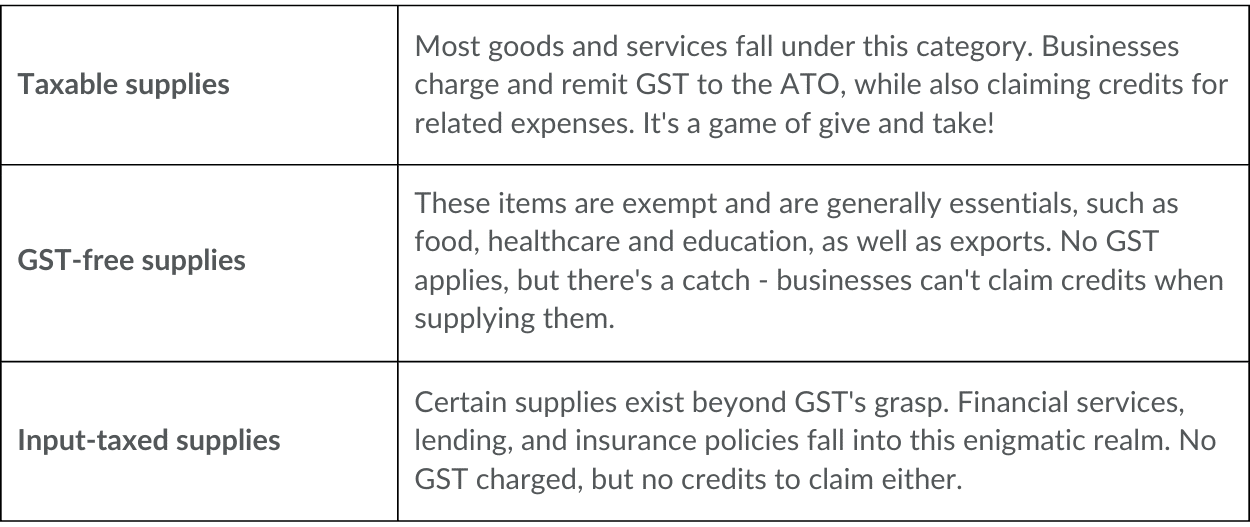

For those unfamiliar with the complexities of the GST system, let’s start with a quick overview. GST is a value-added tax applied at a flat rate of 10% to most goods, services, and items consumed or sold within Australia. Here’s a breakdown of the different categories for GST purposes:

If your enterprise has current or projected turnover from Australian sales of $75,000 within 12 months, it is time to register for GST. GST turnover includes an enterprise’s income from Australian sales but can include several adjustments. Careful consideration of these adjustments should be made.

Even if you’re below the threshold, do not dismiss GST! A tax advisor can guide regarding potential benefits for registration, such as the ability to claim valuable GST credits.

How do you determine if a crypto asset is digital currency for GST purposes?

The ATO considers digital currency for GST purposes to be a crypto asset utilising cryptography and distributed ledger technology to make secure transactions. Several characteristics of digital currency are outlined in the guidance here, none of which are particularly controversial.

The Commissioner has excluded loyalty points, in-game tokens, non-fungible tokens (NFTs), stablecoins, and initial coin offerings (ICOs) (if they fall under securities or derivatives) from this definition. Unless GST free (for example, supplied to overseas customers) then the following treatment is made for key crypto assets:

- the supply of NFTs is taxable

- stablecoins and ICOs are input-taxed financial supplies, and

- if the ICO gives a right or entitlement to goods and services, then the supply will not be a digital currency but will be taxable.

The ATO’s stance on NFTs has raised concerns in the industry for many projects and marketplaces. With GST now clearly payable, NFT projects and platforms must register, report, and pay GST when supplying to Australia or its residents. This burden is significant and may prompt some projects to consider offshore moves or limiting access to Australians.

What should you do when you receive and use digital currency as payment for goods and services?

When using digital currency for payments in a GST-registered enterprise, the Commissioner advises that:

- If receiving digital currency as payment for a taxable supply, the GST amount must be reported in Australian dollars on the business activity statement. Don’t forget, your tax invoice should include the GST payable in Australian dollars or provide sufficient information to calculate it accurately.

- When using digital currency for purchases and claiming GST credits, be sure to report the GST amount in Australian dollars on your business activity statement. Remember, your tax invoice is key and must provide the necessary information.

To work out the value of your digital currency for your business activity statement, you must use the exchange rate on the conversion day that applies to you. The rate can be obtained from a digital currency exchange or agreed upon between the parties. The conversion day is determined based on accounting methods (cash basis or non-cash basis). Additional guidance is available for non-resident entities regarding the determination of the conversion day.

The ATO’s guidance on this topic can be found here.

How does GST apply to digital currency exchanges?

A digital currency exchange is an online platform that facilitates the trading of crypto assets (this excludes NFTs, which are addressed in separate guidance) for fiat currency or other crypto assets. The tax treatment of a digital currency exchange depends on the nature of the services provided and the residency of the users.

Specifically:

- if your exchange services cater to Australian residents, it’s a taxable supply. You must report and pay GST on these transactions.

- when your services extend beyond Australia’s borders to non-residents then the transactions are GST-free, meaning no reporting or GST payment required.

Attention, overseas exchanges! If you provide exchange services to Australia and exceed the GST turnover threshold, you too must register, report, and pay GST in Australia. There are many steps to this process including determining if you meet Australia’s definition of ‘carrying on an enterprise’ and fulfill all GST provisions. Where your exchange is intending to service Australians, advice should be sought from a local expert.

The ATO’s guidance on this topic can be found here.

What is the GST treatment when you buy or sell digital currency?

Identifying the location of your trading partners can be difficult. Thankfully, the ATO accepts using the location of the digital currency exchange as a reliable indicator. Once the location is determined, the GST consequences of trading digital currency are as follows:

- When you trade with Australian residents, it falls under the category of input-taxed financial supply. You don’t need to pay GST on these supplies.

- When your trades extend beyond Australian borders or involve foreign digital currency exchanges, GST takes a back seat. Trading with non-residents qualifies as a GST-free supply, freeing you from GST obligations.

Be warned! While GST-free supplies spare you from paying GST, there’s a vital checkpoint to remember. If you supply digital currency, carry on an enterprise, and exceed the GST turnover threshold, you must register for GST.

The ATO’s guidance can be found here.

Conclusion

In conclusion, the ATO has issued new GST guidance for crypto assets, addressing topics such as determining digital currency for GST purposes, handling digital currency payments, applying GST to digital currency exchanges, and the GST treatment for buying or selling digital currency. Understanding GST complexities is crucial for individuals and businesses in the crypto space.

Our team of tax lawyers have expertise in crypto and GST and can provide tailored advice and assistance. Whether you need help with asset classification, transaction compliance, or understanding GST implications, contact one of our team members today.

This article is part of the Blockchain Byte series by KHQ’s Tax & Structuring team. The series provides ‘byte-sized’ articles outlining key tax and structuring issues associated with crypto assets as well as updates in the Blockchain space which regularly occur. To register for the latest byte and other tax and structuring news, click here to subscribe.