DO YOU NEED A LICENCE TO DRIVE THAT THING?

What is a CCIV?

A corporate collective investment vehicle (CCIV) is:

- a new type of company that is limited by shares, and has a public company as its single corporate director which holds a CCIV-compliant AFSL;

- a tax-effective alternative to a managed investment scheme (“MIS”); and

- an umbrella vehicle that can comprise one or more ‘sub-funds’, allowing it to offer multiple products and investment strategies within the one vehicle.

The introduction of the CCIV regime aims to attract foreign investment. The CCIV is based on corporate structures foreign investors already engage with in other jurisdictions.

There will be two types of CCIVs: retail and wholesale. A CCIV will be a retail CCIV if it has at least one investor that acquires securities in the CCIV as a ‘retail client’. An investor will acquire securities as a ‘retail client’ if a PDS (product disclosure statement) is required to be given to them when the securities were issued or transferred to them. If a CCIV is not a retail CCIV it will be a wholesale CCIV.

What is ASIC’s proposed licensing guidance?

ASIC is seeking feedback on five aspects of its proposed CCIV licensing arrangements:

- applications for a CCIV-compliant AFSL;

- new proof requirements for corporate directors;

- organisational competence requirements for CCIVs;

- compensation and insurance arrangements for corporate directors; and

- financial resource requirements for corporate directors.

1. Applications for a CCIV-compliant AFSL

A corporate director will require a CCIV-compliant AFSL to operate the business and conduct the affairs of a CCIV.

ASIC may in some circumstances grant this subject to a condition that limits the corporate director to operating one CCIV with a single sub-fund. For instance, if the corporate director fails to demonstrate that it has sufficient organisational competence and capacity.

A corporate director will require an AFSL to provide financial product advice in respect of and/or deal in CCIV securities, unless it is already licenced to:

- provide financial advice in respect of and/or deal in securities; or

- provide financial product advice in respect of and/or deal in interests in MISs and consents to an ASIC initiated licence variation to include securities in a CCIV (in which case, ASIC will contact these AFSL holders directly).

2. New proof requirements for corporate directors

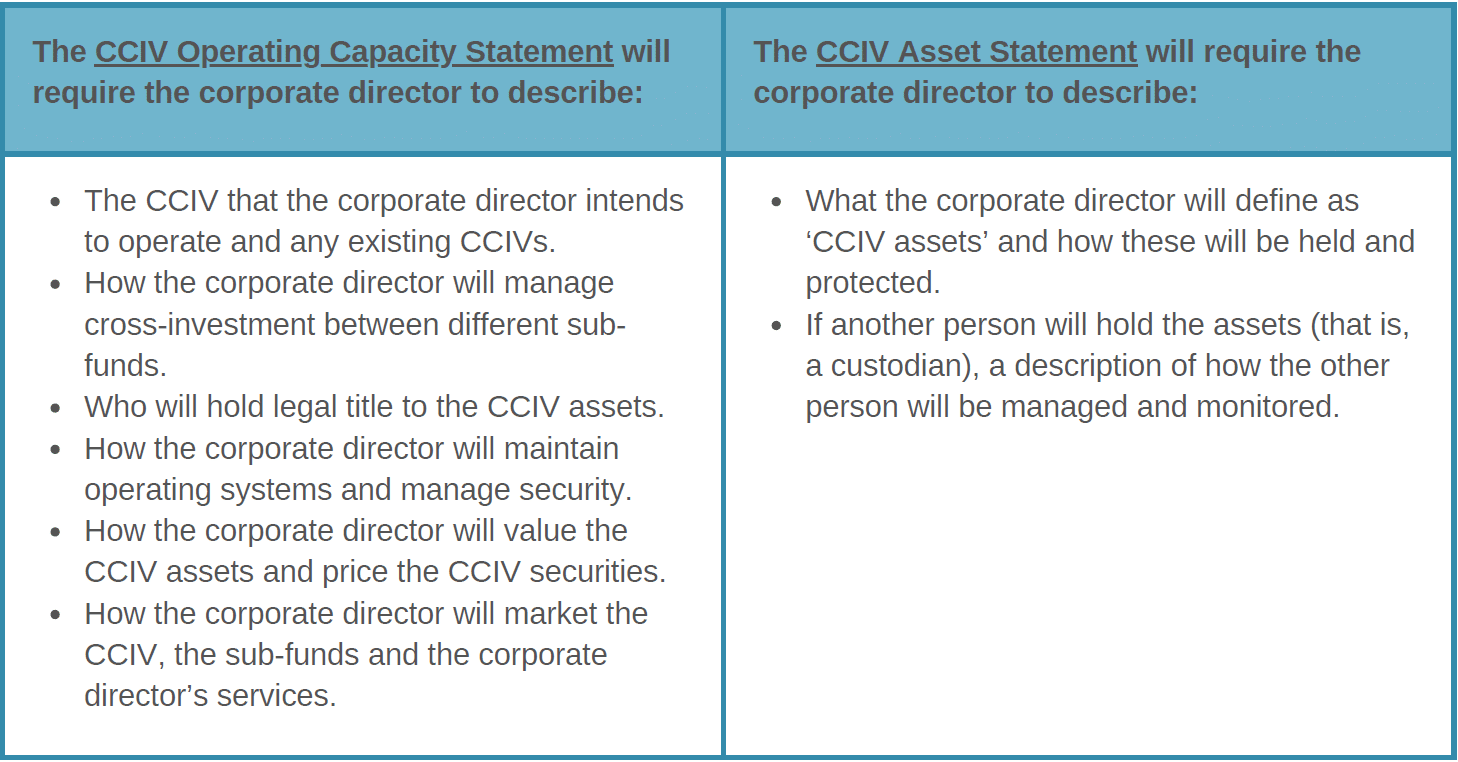

A corporate director will be required to submit the following new proofs with its application for, or variation to, an AFSL that authorises it to run a CCIV:

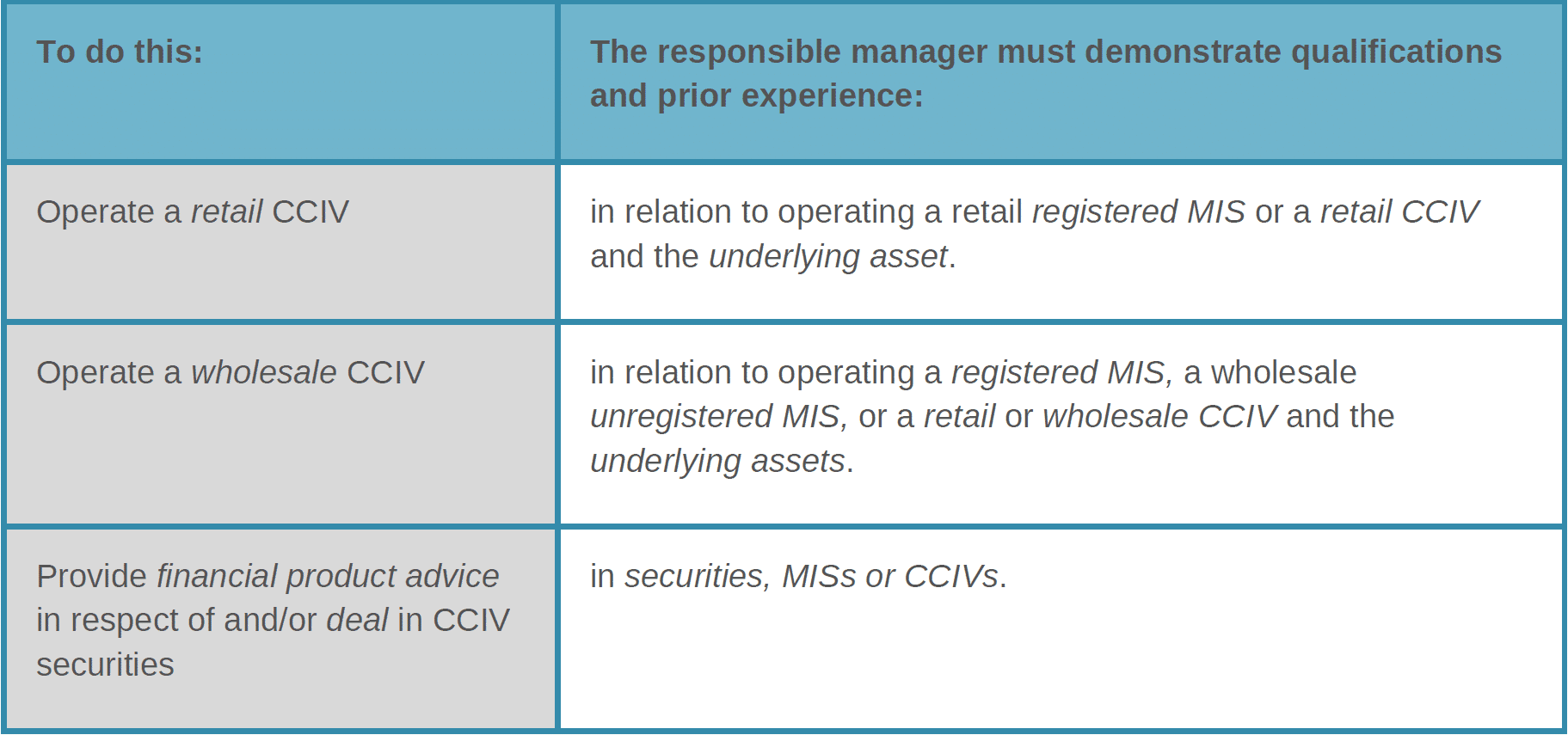

3. Organisational competence requirements for CCIVs

ASIC will impose requirements similar to those for operating a MIS. Each corporate director will need to have at least one responsible manager. ASIC will consider overseas experience.

4. Compensation and insurance arrangements for corporate directors

A corporate director of a retail CCIVs will be required to obtain a professional indemnity (PI) insurance policy (similar to the requirements for operating a registered MIS), through a condition on its AFSL which will:

- require that an insurance policy covering PI and fraud by officers is maintained;

- require that PI insurance is adequate, considering the nature of activities the corporate director carries out under its AFSL; and

- ensure that the PI insurance covers claims amounting in aggregate to the lesser of:

- A$5 million; or

- the value of the CCIV assets of all retail CCIVs it operates.

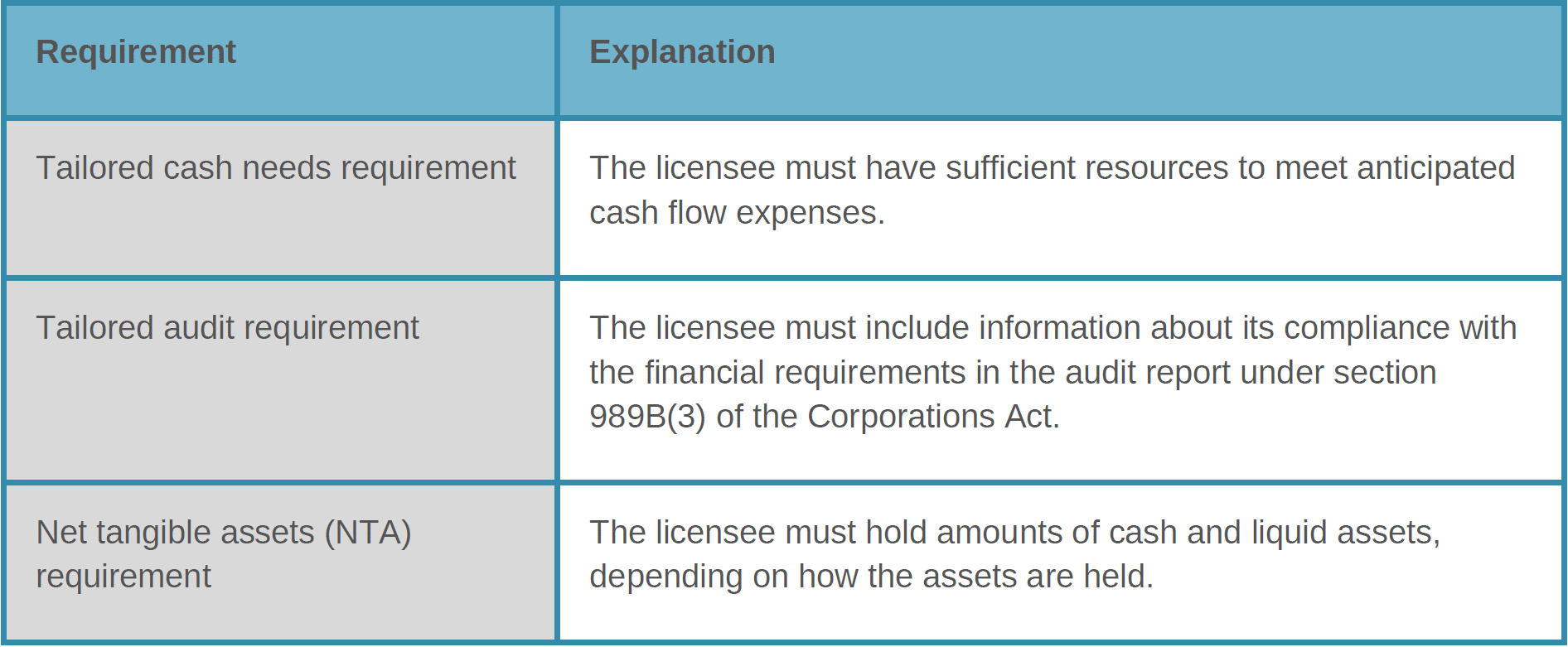

5. Financial resource requirements for corporate directors

A corporate director of a retail CCIV will need to meet the following requirements:

A corporate director of a wholesale CCIV must meet the base level financial requirements that apply generally to AFS licensees.

Next steps

These proposals are only an indication, although a strong one, of the approach that ASIC will take in relation to licensing for the new CCIV regime. Consultation closed on 14 April 2022. ASIC will release its final guidance by 30 June 2022.

For more information, or to discuss financial services queries in general, please contact a member of KHQ’s Corporate & Commercial or Superannuation & Financial Services teams, on +61 (0)3 9663 9877.

This article was written by Venn King (Principal Solicitor), Natalie Cambrell (Principal Solicitor) & Trent Wedding (Paralegal) of KHQ Lawyers.